Western CPE Blog

5 min read

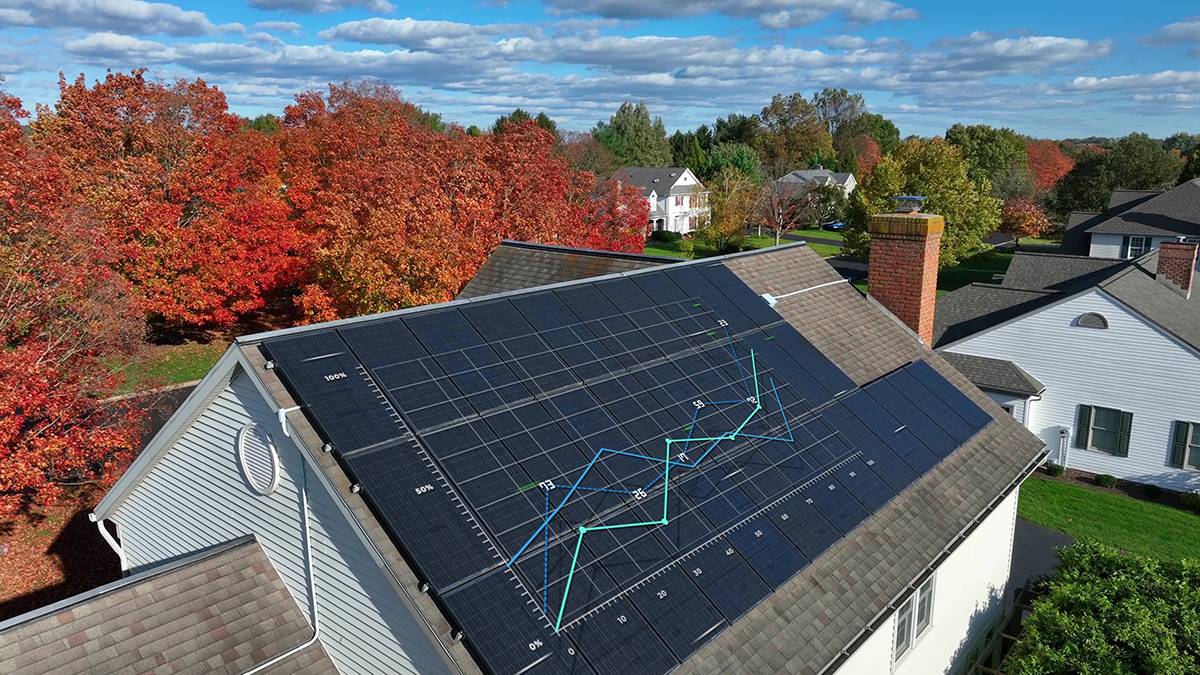

The gig economy continues to expand rapidly, with 64 million Americans now participating in on-demand work through digital platforms. As an Enrolled Agent, you are uniquely positioned to serve this growing demographic. Gig workers need specialized tax guidance that aligns with your expertise in taxation and representation. This guide will outline the challenges and actionable […]

Recent Blog Posts

5 min read

The gig economy continues to expand, with approximately 64 million Americans now participating in on-demand

2 min read

In a significant decision, the Sixth Circuit reversed a Tax Court ruling that had treated

2 min read

When Melissa Correll claimed her 16-year-old son as a dependent on her 2021 return even

2 min read

In a recent decision, the court granted summary judgment to the government in a case

4 min read

A nearly $188,000 personal tax liability struck board member Kristopher Dreyer when the Ninth Circuit

6 min read

The IRS defines the gig economy as “activity where people earn income providing on-demand work,

12 min read

Revenue Procedure 2025-10 provides updated guidance on Section 530 relief—the first update since 1985.